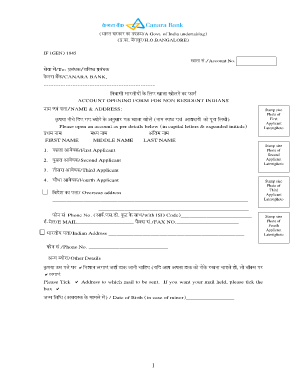

India Syndicate Bank Application for Availing Internet free printable template

Fill out, sign, and share forms from a single PDF platform

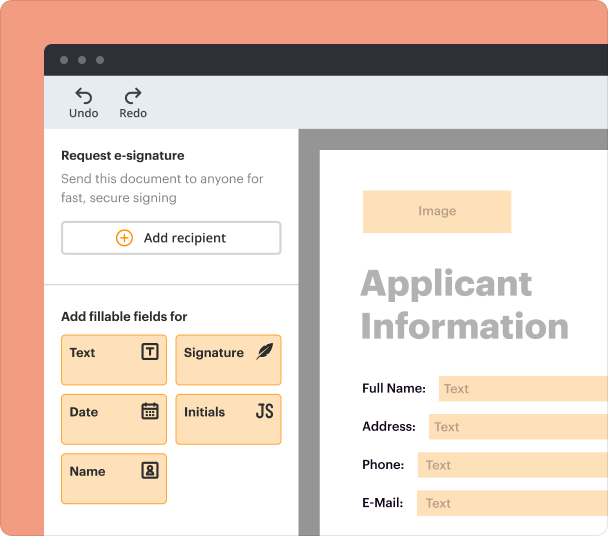

Edit and sign in one place

Create professional forms

Simplify data collection

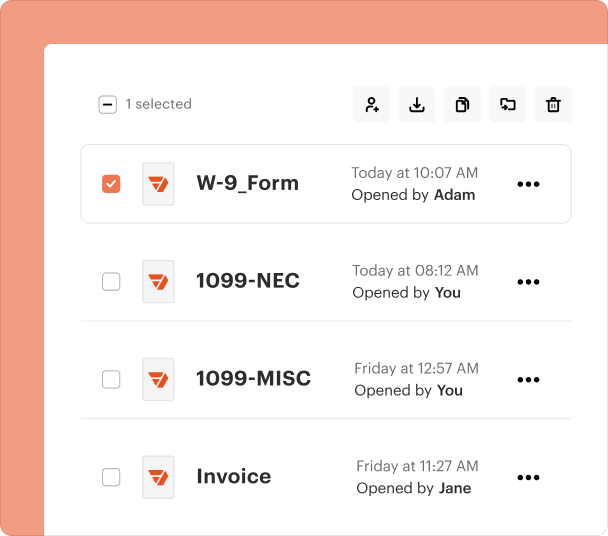

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

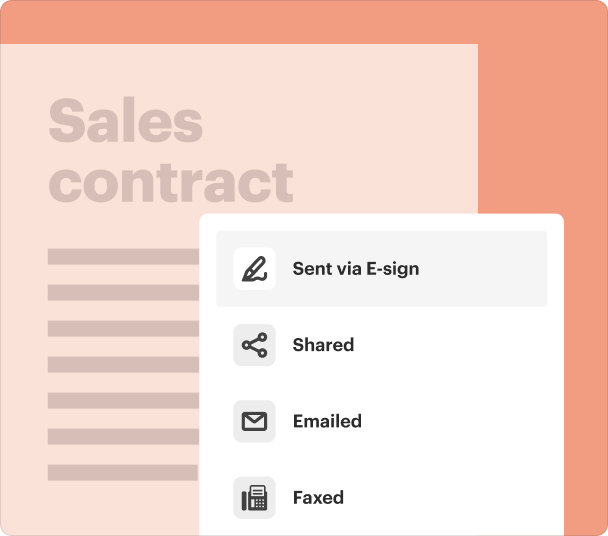

End-to-end document management

Accessible from anywhere

Secure and compliant

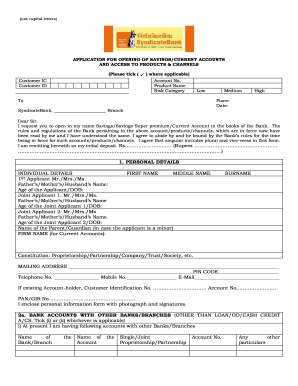

India Syndicate Bank Application Form Guide

Filling out the India Syndicate Bank application form efficiently can pave the way for a smooth banking experience. This guide will walk you through the application process and highlight key steps that ensure accuracy and compliance.

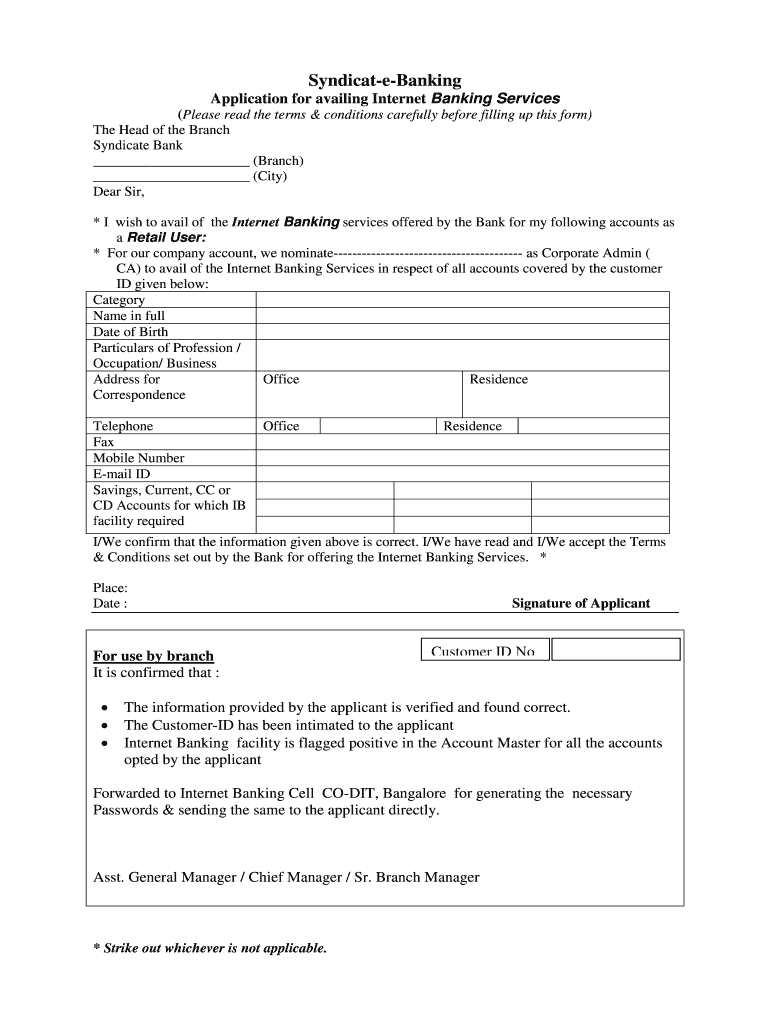

What is the Syndicate Bank Internet Banking Application?

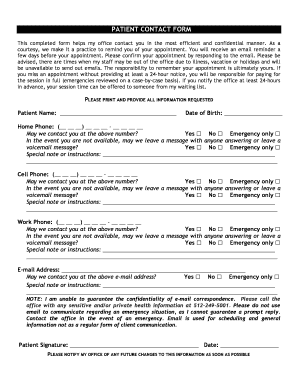

The Syndicate Bank Internet Banking Application is a form that allows customers to access banking services online. Filling out the application correctly is crucial to avoid delays and ensure a seamless banking experience.

-

A digital platform for conducting banking transactions online.

-

The person responsible for managing corporate banking services.

-

A unique identifier assigned to each customer for online banking.

How do complete the application form?

Completing the application form requires attention to detail and accurate information. Follow these steps to ensure a correct submission.

-

Collect all necessary documents and information, such as KYC details.

-

Include accurate details including your name, date of birth, and address.

-

This is critical for businesses that need multiple users.

-

Provide telephone, fax, mobile, and e-mail for further communication.

-

Indicate whether you need services for savings, current, CC, or CD accounts.

-

Your signature ensures all details are correct and truthful.

What are the important terms and conditions?

Understanding the terms and conditions is essential to utilizing internet banking services effectively. These guidelines outline your responsibilities and what to expect during banking.

-

Carefully read all conditions related to internet banking services.

-

You are responsible for maintaining security and confidentiality of your login information.

-

Incorrect information may lead to delays or rejection of your application.

How to submit and process the application?

Submission of the application form is a crucial step in accessing internet banking services. Understanding the procedure can help in the timely processing of your application.

-

Submit the completed application online or at your nearest branch.

-

Typically, verification takes between 5-7 business days.

-

After approval, you will receive your Customer ID and additional credentials.

What are common issues during the application process?

While applying for services, applicants may encounter several issues. Understanding these common pitfalls can help navigate the process more effectively.

-

Incomplete applications can lead to processing delays; always double-check your form.

-

If delays occur, reach out to customer service for updates.

-

In case of technical difficulties, try refreshing the page or clearing your browser cache.

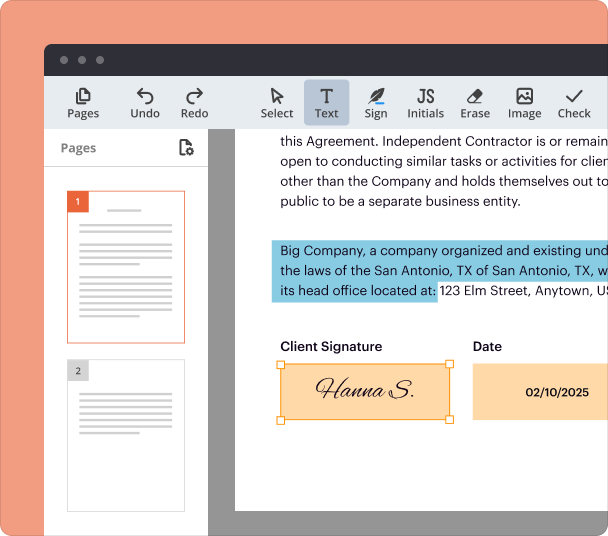

How can leverage pdfFiller for my application needs?

pdfFiller enhances your application experience by allowing you to efficiently fill out and edit forms. Utilizing this tool can streamline the process considerably.

-

Make the process of completing forms quick and easy with editable PDFs.

-

Ensure your document is signed digitally and securely within the platform.

-

Use pdfFiller's cloud-based platform for team collaboration on applications.

What is the accessibility of internet banking services?

Internet banking provides numerous advantages for users looking for convenience and efficiency. Understanding these benefits is key to leveraging your banking resources.

-

Access your account anytime and anywhere with internet connectivity.

-

Services include money transfers, bill payments, and account management.

-

Syndicate Bank implements robust security measures to protect online transactions.

What are the next steps after application approval?

Once your application is approved, several critical steps will follow. Ensuring you complete these will help you get the most out of your banking services.

-

Your unique customer ID and passwords will allow you to access your online banking account.

-

Follow the simple steps to log in and set up your account settings.

-

Take advantage of the range of services offered through internet banking.

Frequently Asked Questions about the 'customerid' printed on the id related to their accounts form

What is the main purpose of the Syndicate Bank application form?

The main purpose of the Syndicate Bank application form is to enable customers to enroll in online banking services. It allows users to manage their accounts and conduct transactions over the internet securely.

How long does it usually take to process the application?

Typically, the processing time for the application is between 5 to 7 business days. However, this can vary depending on the volume of applications and completeness of submissions.

What should I do if I encounter technical issues while filling the form?

If you face technical difficulties while completing the form, it is recommended to refresh your browser or clear your cache. If issues persist, contact customer support for guidance.

Can I submit my application form online?

Yes, you can submit your application form online. Ensure that all required information is filled out correctly before submitting to avoid delays.

What is the significance of customer ID in the application form?

The customer ID is a unique identifier assigned to each customer, pivotal for accessing online banking. It is used to log in to your internet banking account securely.

pdfFiller scores top ratings on review platforms